Eic 2025 Tax Table Married Jointly

Eic 2025 Tax Table Married Jointly. 2023 alternative minimum tax (amt) exemptions Find the latest and past tax brackets and standard deduction amounts for 2025 and beyond.

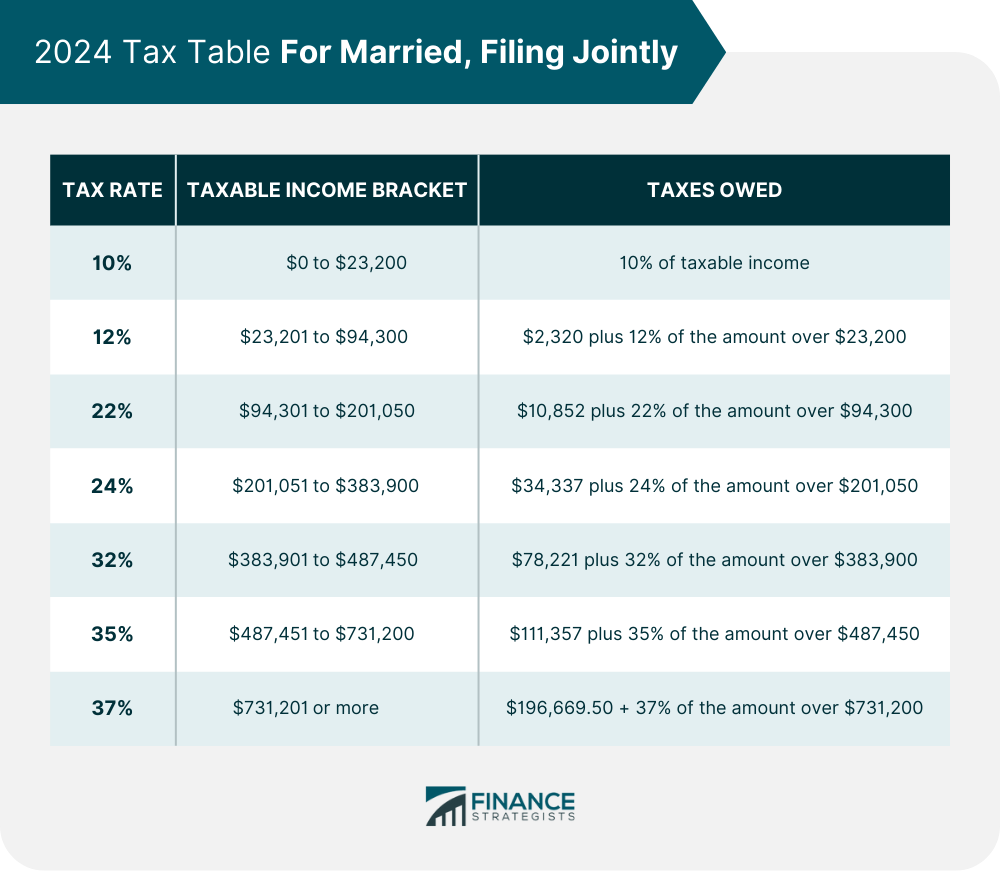

Find out the federal income tax rates, brackets, and standard deduction amounts for 2025. Find the latest tax rates and thresholds for 2025 federal income tax returns, as well as links to historic and state tax tables.

Eic 2025 Tax Table Married Jointly Images References :

Source: imagetou.com

Source: imagetou.com

Earned Credit 2025 Tax Table Image to u, Find out the standard deduction amounts for married filing jointly and other filing statuses in 2025 and 2025.

Source: www.trustetc.com

Source: www.trustetc.com

2025 Tax Brackets Announced What’s Different?, If you earned less than $66,819 (if married filing jointly) or $59,899 (if filing as single, qualifying surviving spouse or head of household) in tax year 2025, you may qualify.

Source: arlynqyettie.pages.dev

Source: arlynqyettie.pages.dev

Married Filing Jointly Capital Gains Tax Brackets 2025 Megen Sidoney, The alternative minimum tax exemption amount for tax year 2025 is $85,700 and begins to phase out at $609,350 ($133,300 for married couples filing jointly for whom the exemption.

Source: eleenrosette.pages.dev

Source: eleenrosette.pages.dev

2025 Married Filing Jointly Tax Table Ibbie Laverne, Compare the eic amounts and.

Source: cheriannewnada.pages.dev

Source: cheriannewnada.pages.dev

Tax Brackets 2025 Usa Married Filing Jointly Jessi Lucille, Use the online 2025 tax calculator to estimate your tax liability.

Source: hannahjoycelin.pages.dev

Source: hannahjoycelin.pages.dev

Us Tax Brackets 2025 Married Filing Jointly Vs Single Gretta Lillis, Enter your information and see a breakdown of your taxable income and tax.

Source: tobyqsallyann.pages.dev

Source: tobyqsallyann.pages.dev

2025 Tax Brackets Married Jointly Tax Brackets Dorrie Chryste, The alternative minimum tax exemption amount for tax year 2025 is $85,700 and begins to phase out at $609,350 ($133,300 for married couples filing jointly for whom the exemption.

Source: renaemeridel.pages.dev

Source: renaemeridel.pages.dev

Us Tax Brackets 2025 Married Jointly Irs Deny Stephine, Use this online tool to calculate your earned income credit (eic) based on your filing status, number of qualifying children, and total earned income.

Source: danellyteresa.pages.dev

Source: danellyteresa.pages.dev

2025 Tax Rates Table Married Jointly Emili Inesita, The alternative minimum tax exemption amount for tax year 2025 is $85,700 and begins to phase out at $609,350 ($133,300 for married couples filing jointly for whom the exemption.

Source: pruqcristie.pages.dev

Source: pruqcristie.pages.dev

Tax Brackets 2025 Married Jointly Explained Cathi Danella, Learn how tax brackets work and find the current and future tax rates for different filing statuses.

Posted in 2025